What our Clients Say About Us

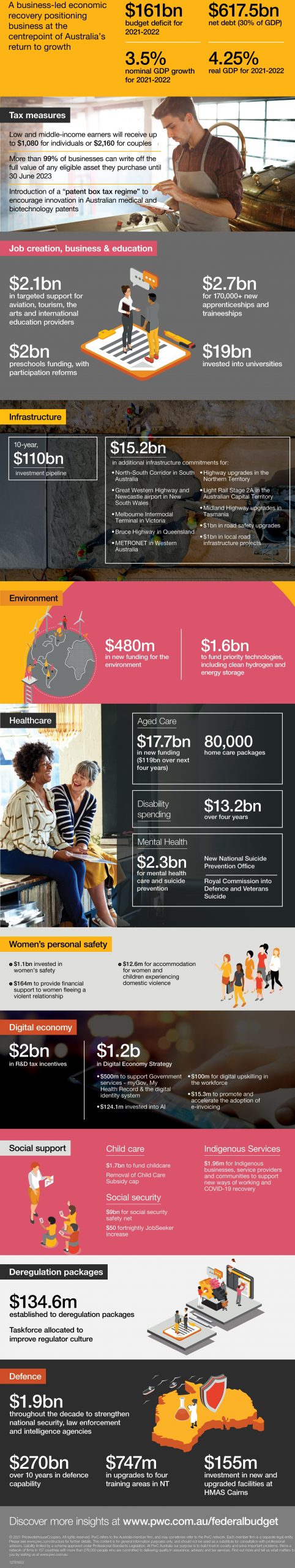

The 2021 Federal Budget Explained

Last night, the Government handed down the 2021 Federal Budget.

The objective of this Budget is pretty simple – economic recovery – by increased spending, lower taxes, job training and re-skilling workers.

A stimulatory Federal Budget on a standalone basis is beneficial for the sharemarket. Tax cuts have the potential to boost consumer and business spending, putting extra dollars in people’s pockets and boosting confidence levels. Of course, economic recovery also depends on whether people have jobs, are confident about securing a job, and what happens with wages.

Looking through the array of stimulus measures, there are a host of factors that will affect Australian economy.

Some of the key takeaways from this budget include:

- Removal of the work test. From 1 July 2022, individuals up to the age of 74 years will be allowed to make or receive non-concessional or salary sacrifice super contributions without meeting the work test.

- Downsizer contribution. The Government will reduce the minimum age requirement for the downsizer contribution from 65 to 60.

- First Home Super Saver Scheme. From 1 July 2022 the Government will increase the amount of super savings available to first home buyers from $30,000 to $50,000.

- SMSF residency requirements. The Government will amend the SMSF residency requirements to make it easier for funds to maintain their complying status where members move overseas.

- Complying income stream conversions. Individuals will be given two years to exit a specified range of complying retirement income stream products, such as term-allocated pensions.

- Aged care reforms. In response to the Royal Commission into Aged Care Quality and Safety, the Government is investing $17.7 billion over five years to improve the aged care system.

Below is the Federal Budget overview that explains the key outcomes and what they mean to you.

Supporting you through the changes

This year has been a challenging time for everyone and so if you have any concerns, or would like to discuss your financial strategy, it’s more important than ever to get in touch. Feel free to arrange an appointment by contacting us on 089476 9999 or paul@fortuanfinancial.com.au